CoreLogic aggregates data from public, contributory, and proprietary sources, encompassing over 4.5 billion records from the past 50 years. This extensive dataset covers property, mortgages, consumer credit, hazard risk, and more, providing government entities with the insights needed to understand macroeconomics and housing markets, predict impacts, and make informed policy decisions. Additionally, CoreLogic’s Climate Risk Analytics offers a detailed assessment of physical risks, helping governments estimate and mitigate future catastrophes while building resilient communities.

Core data solutions: Climate Risk Analytics

CoreLogic’s catastrophe risk models are designed to integrate proprietary datasets, providing a comprehensive single score that evaluates exposure to several natural hazards, including earthquakes, wildfires, inland floods, severe storms, winter storms, hurricanes and storm surges.

Benefits:

- Have a clear definition of the climate risk

- Translate peril risk exposure into economic impact

- Identify, score and disclose property risk scores across the U.S.

- Drive prevention/mitigation measures

Core data solutions: Property & Transactions

This solution provides you with intelligence encompassing (1) Property records and characteristics; (2) Owner transfer; (3) Mortgage transactions

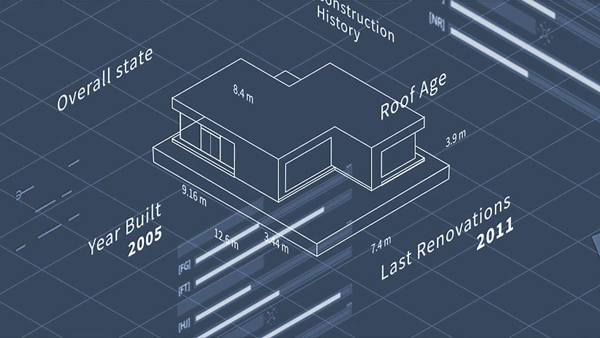

Property – Offering nationwide coverage, CoreLogic provides detailed data on over 152 million parcels through its Property Basic service. This robust dataset includes parcel and subdivision information, geospatial data, owner and mailing details, property values, tax assessments and a comprehensive profile of property characteristics, including structural attributes.

Ownership Transfers – This feature tracks sales and ownership changes over the past 50 years, delivering detailed insights into buyer and seller activity as well as transaction specifics.

Mortgage – Access to historical mortgage transactions provides details on borrower and lender information, mortgage terms and lender identifiers (NMLS ID), covering up to five decades of history.

Benefits:

- Empower property-level search, validation, and assessment (property-specific information, ownership changes, building cost, etc.)

- Most comprehensive, current, and accurate data (Breadth – 5.5B+ property-related records spanning 50+ years; Depth – Expansive data collection including property data, transactions data, geospatial data, MLS data, Appraisal data; Accuracy – Data processing and quality monitoring through a variety of AI/ML techniques; Currentness – 99.75% proximity to source, deliver new and updated data with unprecedented speed; Quality and Enrichment – CoreLogic applies comprehensive quality checks from initial acquisition to data distribution followed by a host of proprietary transformation rules we’ve developed and evolved over decades of data management)

- Flexible Delivery Mechanisms: Data Exchange (cloud-based data exchanges and marketplaces); Bulk Delivery (vis sFTP); CoreLogic Workbench Platform (designed for your data scientists); API solutions (Comprehensive and easy-to-use set of RESTful APIs), etc.

- Faster contracting process using Carahsoft’s contracting vehicle as CoreLogic is a certified vendor pre-approved by Carahsoft

Core Data Solutions: Real Estate Analytics

MarketTrends- Enables the identification of new market opportunities, valuation trends and performance analysis through monthly data snapshots that support benchmarking.

ListingTrends- With extensive U.S. Multiple Listing Services (MLS) data, this tool offers ZIP Code-level housing market insights, delivering monthly updates.

RentalTrends- Focuses on rental market data, providing in-depth information on rent rates, capitalization rates, and vacancy levels, all derived from advanced data and modeling for efficient research.

CoreLogic Home Price Index (HPI) – Offers an early look at home price fluctuations, serving as a foundational tool for evaluating collateral values and assessing mortgage risks.

Benefits:

- Enable government officials to understand macroeconomics, predict impacts, monitor portfolio and manage valuation risks, make sound decisions and policy recommendations

- Most current, comprehensive set of home-price indexes and time-series housing market data

- Flexible Delivery Mechanisms: Data Exchange (cloud-based data exchanges and marketplaces); Bulk Delivery (vis sFTP); CoreLogic Workbench Platform (designed for your data scientists); API solutions (Comprehensive and easy-to-use set of RESTful APIs), etc.

- Faster contracting process using Carahsoft’s contracting vehicle as CoreLogic is a certified vendor pre-approved by Carahsoft

Core Data Solutions: Loan Performance

Loan Level Market Analytics (LLMA)

The Loan-Level Market Analytics and Loan-Level Home Equity datasets offer an extensive view into mortgage loans and home equity lines, providing a broad perspective on portfolio risk exposure.

Non-Agency Residential Mortgage Backed Securities (NARMBS)

CoreLogic® non-agency Residential Mortgage Backed Securities (RMBS) is one of the industry’s most comprehensive databases for tracking credit risks, such as prepayment and delinquency, post-housing crisis.

Benefits:

- Provide loan-level insights that (1) regulators can rely on for market and policy research (e.g., underwriting regulations, forbearance risks); (2) government investors can leverage to monitor and manage mortgage portfolio loan risk in areas such as borrower histories, default risk, and loan fraud, etc.

- Ensure accuracy, improve data management processes, and reduce the extra effort analysts spend manipulating raw data solutions

- Flexible Delivery Mechanisms: Data Exchange (cloud-based data exchanges and marketplaces); Bulk Delivery (vis sFTP); CoreLogic Workbench Platform (designed for your data scientists); API solutions (Comprehensive and easy-to-use set of RESTful APIs), etc.

- Faster contracting process using Carahsoft’s contracting vehicle as CoreLogic is a certified vendor pre-approved by Carahsoft

RESTful APIs

Harness the strength of industry-leading property data and analytics in real-time to drive your websites, apps, and software.

CoreLogic® transforms raw property data into high-value information, analytics and services—and makes it all available via a comprehensive and easy-to-use set of RESTful APIs.

CoreLogic has the following RESTful APIs available:

Search your Property with:

- Address (complete or Partial Address (Type Ahead))

- Owner Name

- CLIP™ number from CoreLogic

- APN

Access Core Property Data:

- Property Detail (Composite Report)

- Building Characteristics

- HOA information

- Flood Zone identification

- Legal & Vesting

- Comparables

- Current Tax Assessment

- Ownership and Owner Transfers

- Location including longitude and latitude coordinates

Access Key Transaction and Financial Data:

- Last Market Sale

- Sales History

- Financial History

- Mortgage Transaction history

- Voluntary Liens

- Automated Valuation Models AVM

Summary of benefits:

- Instant, Automated, and Frictionless: enable your portal user experience by pre-populating information they can then verify

- Easy & Universal: Integration for better efficiency and reliability

- Agile & Innovative: Product development process support, build smarter applications with our data